|

|

THE PUBLIC SUPPORT TEST for 501(c)(3) ORGANIZATIONS: Remember your

Fractions* (click to download

printable version in PDF)

501(c)(3) Status. Organizations are recognized as exempt under Section "501(c)(3)" of the Internal Revenue Code because they are "organized" and "operated" for "exempt purposes" and are "not-for-profit." The 501(c)(3) exemption means that they pay no tax on revenues, and (in most cases) that donors get a deduction when making gifts to them.

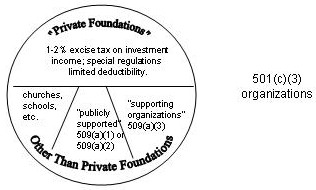

501(c)(3) Universe: "Private Foundations" + "Public Charities." In the world of 501(c)(3) there are two categories: "private foundations" and "other than private foundations," often called "public charities." "Private foundations" are generally treated less favorably than "public charities." Why? The key to being a "public charity" is support from the general public. Congress thought that the need to keep raising money from the general public would keep "public charities" honest. By contrast, Congress though that "private foundations," living off the income from a large fund, controlled by a select few, with no need to demonstrate their good works to the public, would not "keep honest" without regulation.

How Do You Get to be "Other Than" a "Private Foundation"?

The "other than private foundations" (“public charities”) subcategory

within the 501(3) category includes things like schools, churches,

hospitals and research affiliates, and also "publicly supported"

organizations (all of these are 509(a)(1) or

(2)). Also included, and described in 509(a)(3),

are "supporting organizations," of which there are essentially three

types. A supporting organization must "support" one or more 509(a)(1) or (2) organizations. The following

figure illustrates the world of private foundations and "other than

private foundations" ("public charities").

Section 509(a)(1)

How can the organization meet these 1/3 or 10% tests? There are two tricky aspects to this, one "bad" and three "good." "Unhelpful" and "helpful" might be another way to explain it.

The "bad" part is that when computing these fractions, the amount by

which an individual donation (by which we mean, from any individual

person or corporation, or from a non-publicly supported charity (e.g.,

a private foundation) exceeds 2% of the total DOES NOT GO INTO

THE NUMERATOR, but it DOES GO INTO THE DENOMINATOR. This means

that significant financial support given by an individual, a

corporation, or even another non-publicly supported organization, could

jeopardize the organization's status as other than a private foundation.

The first "good" thing is that

gifts of services, or use of space, do not count in either numerator or

denominator. The second "good" thing is that "unusual grants"

(explained at length y regulation) also do not count. The third

"good" thing can really "save the day" for any organization that has a

small budget: contributions from government or other publicly

supported organizations count in BOTH numerator and denominator.

(Contributions from an organization's own supporting organization

wouldn't qualify because it is not, itself, publicly supported.)

To

qualify as "other than a private foundation" under section 509(a)(2) as a "publicly supported"

organization, an organization must pass the "1/3" and "not more than

1/3" tests. It doesn't get a 10% exception. These tests are

explained in Treasury Regulation sec. 1.509(a)-3.

A 509(a)(2) organization has a 1/3 public

support test similar to the one discussed above, but with some major

differences. It DOES include in its numerator not only gifts and

grants, but receipts from exempt activities (e.g. theater tickets for a

theater) -- let's call those "fees." This is why we sometimes think of

this section as appropriate for "service-providing" organizations,

those that "earn" their income. But it can NOT include "fees"

received from any individual, corporation or government agency that

exceed the greater of 1% of the total or $5,000. In other words,

when it comes to "fees," the numerator has instead of a "2%" test, a

"greater of 1% or $5,000" test. It also can NOT include in its

numerator ANY receipts from "disqualified persons." These include board

members and "major donors" and those with certain family or business

relationships. "Major donor" has a very technical definition, but

if anyone gives over $5,000, look this up in Regulations section 1.507-6(b)(1).

The organization must also pass another test: it is prohibited

from having more than 1/3 of its income come from a combination

of investment income and net unrelated business income.

(Investment income from its supporting organization would pass through

and be treated as its own.)

Although

509(a)(2) is designed for what one could think of as "service-providing

organizations," it can also help out a very small organization that has

a few donors who give more than the 2% that would be a problem

under 509(a)(1).

Observe that if this were a 509(a)(1) organization, the contributions of M, N, O and P would count as $2,000 each (2% x $100,000), but on the other hand, the contribution of each Major Donor would count for $2,000 rather than zero; accordingly, there would be $30,000 in the numerator. DISCLAIMER: Return to sharinglaw.net nonprofit page |

|